Mesothelioma Trust Funds: How They Work and Who’s Eligible

Mesothelioma trust funds allow people with asbestos-related illnesses to file claims for compensation against bankrupt asbestos manufacturers. Trust funds only pay a percentage of the value of a claim, but they pay out quicker than lawsuits.

Our content is developed and backed by respected legal, medical and scientific experts. More than 30 contributors, including product liability attorneys and board-certified physicians, have reviewed our website to ensure it’s medically sound and legally accurate.

legal help when you need it most.

Drugwatch has provided people injured by harmful drugs and devices with reliable answers and experienced legal help since 2009. Brought to you by The Wilson Firm LLP, we've pursued justice for more than 20,000 families and secured $324 million in settlements and verdicts against negligent manufacturers.

More than 30 contributors, including mass tort attorneys and board-certified doctors, have reviewed our website and added their unique perspectives to ensure you get the most updated and highest quality information.

Drugwatch.com is AACI-certified as a trusted medical content website and is produced by lawyers, a patient advocate and award-winning journalists whose affiliations include the American Bar Association and the American Medical Writers Association.

About Drugwatch.com

- 15+ Years of Advocacy

- $324 Million Recovered for Clients

- 20,000 Families Helped

- A+ BBB Rating

- 4.9 Stars from Google Reviews

Testimonials

I found Drugwatch to be very helpful with finding the right lawyers. We had the opportunity to share our story as well, so that more people can be aware of NEC. We are forever grateful for them.

- Legally reviewed by Whitney Ray Di Bona, Esquire

- Last update: December 9, 2025

- Est. Read Time: 4 min read

What Are Mesothelioma Trust Funds?

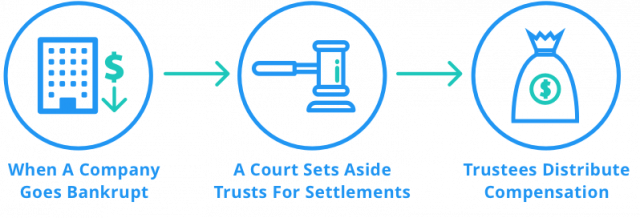

A mesothelioma trust fund is money set aside by companies that manufactured, sold or used asbestos products and later went bankrupt due to asbestos litigation. These companies set up the trusts to compensate people diagnosed with mesothelioma and other asbestos-related illnesses and cancers.

- Armstrong World Industries

- Babcock & Wilcox

- Bondex

- DII Industries

- Federal-Mogul Corporation

- Flexitallic

- Johns Manville

- Kaiser Aluminum

- National Gypsum

- Owens Corning Fibreboard

- Pittsburgh Corning Corporation

- Turner & Newall

- USG Corporation

- W.R. Grace

- Western MacArthur

As of August 2025, about $30 billion is still available in mesothelioma trust funds. Lawyers are currently taking mesothelioma cases and helping people file claims for compensation.

Many mesothelioma claims go through trusts since some asbestos manufacturers are now bankrupt.

How Trust Funds Differ From Lawsuits

Trust fund claims are different from mesothelioma lawsuits because the case is reviewed by a trustee, not a judge or jury. Claimants still have to prove that asbestos caused their injuries, but filing with a trust is typically faster, and you don’t go to court.

If the trustee approves the claim, trust fund payments may begin in as little as a few months.

Lawsuits allow victims to seek additional damages directly in court against companies that are still solvent. They may provide higher payouts, but can be time-consuming and unpredictable.

Trust funds generally pay only a percentage of the value assigned to a claim. On the other hand, lawsuits — such as talcum powder lawsuits due to asbestos-contaminated talc — may result in full compensation if successful.

How Much Compensation Can You Receive?

The average compensation a mesothelioma patient receives from trust funds is between $300,000 and $400,000 because many patients file claims with 20 or more trusts. Some mesothelioma patients can receive millions of dollars by filing claims with multiple trusts.

- Age and occupation

- Payment percentage set by each trust

- Severity of diagnosis

- Whether you file a claim with multiple trusts

Each mesothelioma trust fund claim is different, and there is no guaranteed compensation payout. Furthermore, each trust fund has a set percentage it will pay based on the amount of money in the fund.

For example, if the trust values your claim at $100,000 and the payment percentage is 20%, you would receive $20,000.

Trust Fund Payment Percentages

Trust fund payment percentages currently range up to 60%. These percentages change when trustees adjust payouts based on the amount of money remaining in the trust and projected future claims.

Each fund calculates the value of the claim based on the severity of the disease and other factors, then pays out a percentage of that value.

| Company | Payment Percentage |

|---|---|

| Armstrong World Industries | 10.8% |

| DII Industries | 60% |

| Johns Manville | 5.1% |

| Kaiser Aluminum | 10.6% |

| Owens Corning Fibreboard | 3.7%-4.7% |

| USG Corporation | 11% |

| W.R. Grace | 30.1% |

Who Is Eligible To File a Claim?

You may be eligible for an asbestos trust claim if you received a diagnosis of mesothelioma after exposure to asbestos products, such as contaminated talc.

In addition to mesothelioma, asbestosis and asbestos-related lung cancer are two other diseases that typically qualify for an asbestos trust claim.

Evidence Required To Support Your Claim

Lawyers will require some evidence to support your asbestos trust claim, including:

- A physician’s statement that proves doctors diagnosed you with mesothelioma or another asbestos-related disease.

- Employment records, witness statements or documents showing exposure at company worksites or through company products.

- Medical records and pathology reports confirming your diagnosis and connecting it to asbestos exposure.

When you speak to a lawyer, they can tell you exactly what they need to file your claim. In some cases, they can help you gather the documentation.

How To File a Mesothelioma Trust Fund Claim

In general, there are four steps to filing a mesothelioma trust fund claim. The best way to file is to hire an experienced lawyer to submit the claim for you.

- File a Claim. This includes your occupational history, the source of asbestos exposure and details about your diagnosis.

- Claim Review. A fund trustee reviews claims in the order received, using either an expedited or individual review.

a.) An expedited review groups the claim with similar cases and uses general information to assign a fixed payment.

b.) An individual review assesses the level of exposure, the severity of the disease and the number of dependents a person has. While an individual review takes longer, it may produce higher payouts. - Assigning Value. The trustee determines how much money a claim is worth and adjusts it based on the payment percentage.

- Payout. The trust fund claimant has a time limit for accepting the payment. It varies, but it’s typically 30 days.

Why You Can File With Multiple Trusts

Many claimants received asbestos exposure from more than one company. If you meet the eligibility requirements for several trusts, you can file claims with each to maximize compensation.

Mesothelioma attorneys help identify the correct trusts, prepare evidence and navigate complex procedures, often improving claim success rates and maximizing payouts.

Can You Make a Trust Claim and File a Lawsuit?

You can file trust fund claims against bankrupt companies and also pursue lawsuits against solvent companies that do not have bankruptcy trusts.

Each state has its own deadline, called the statute of limitations, for filing with trusts and in courts. Consulting an attorney helps ensure you meet all deadlines and maximize your payout.

Calling this number connects you with a Drugwatch.com representative. We will direct you to one of our trusted legal partners for a free case review.

Drugwatch.com's trusted legal partners support the organization's mission to keep people safe from dangerous drugs and medical devices. For more information, visit our partners page.